I buy into the “hedgehog/fox” story, when it comes to forecasting. So you have to be dedicated to the numbers, but still cast a wide net. Here are some fun stories, relevant facts, positive developments, and concerns – first Links post for 2015.

Cool Facts and Projections

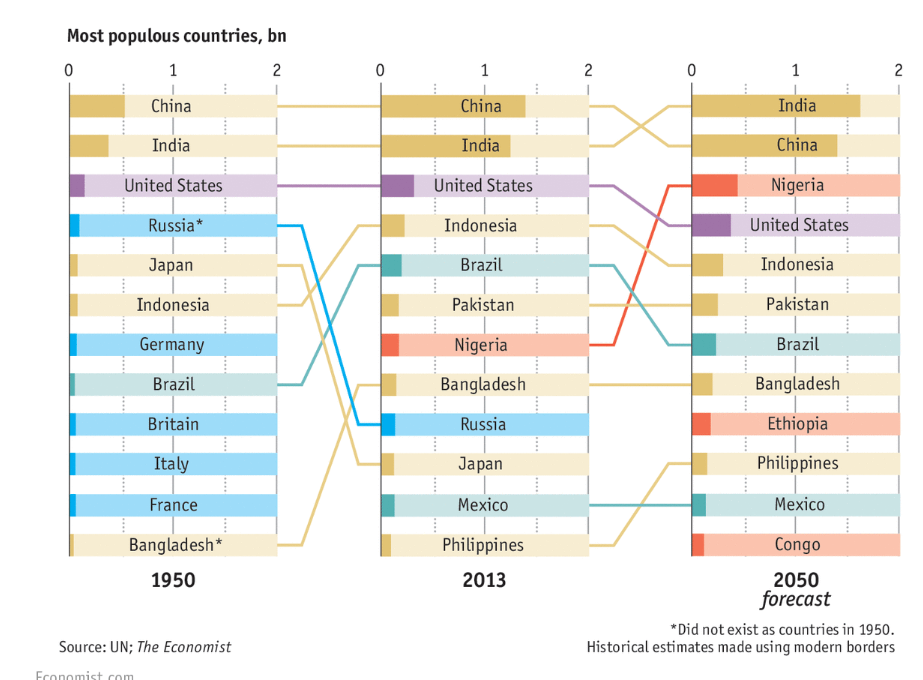

How the world’s population has changed – we all need to keep track of this, 9.6 billion souls by 2050, Nigeria’s population outstrips US.

What does the world eat for breakfast?

Follow a Real New York Taxi’s Daily Slog 30 Days, 30 random cabbie journeys based on actual location data

Information Technology

Could Microsoft’s HoloLens Be The Real Deal?

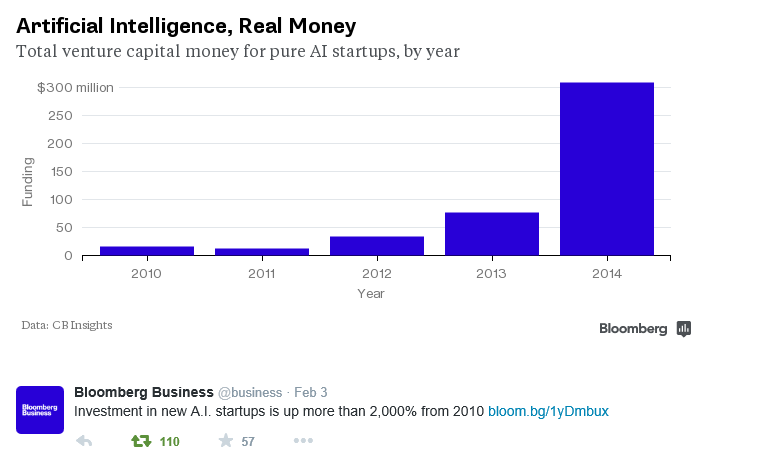

I’ll Be Back: The Return of Artificial Intelligence

Issues

Why tomorrow’s technology needs a regulatory revolution Fascinating article. References genome sequencing and frontier biotech, such as,

Jennifer Doudna, for instance, is at the forefront of one of the most exciting biomedical advances in living memory: engineering the genomes not of plants, but of people. Her cheap and easy Crispr technology holds out the promise that anybody with a gene defect could get that problem fixed, on an individual, bespoke basis. No more one-size-fits all disease cures: everything can now be personalized. The dystopian potential here, of course, is obvious: while Doudna’s name isn’t Frankenstein, you can be sure that if and when her science gains widespread adoption, the parallels will be hammered home ad nauseam.

Doudna is particularly interesting because she doesn’t dismiss fearmongers as anti-science trolls. While she has a certain amount of control over what her own labs do, her scientific breakthrough is in the public domain, now, and already more than 700 papers have been published in the past two years on various aspects of genome engineering. In one high-profile example, a team of researchers found a way of using Doudna’s breakthrough to efficiently and predictably cause lung cancer in mice.

There is more on Doudna’ Innovative Genomics Initiative here, but the initially linked article on the need for regulatory breakthrough goes on to make some interesting observations about Uber and Airbnb, both of which have thrived by ignoring regulations in various cities, or even flagrantly breaking the law.

China

Is China Preparing for Currency War? Provocative header for Bloomberg piece with some real nuggets, such as,

Any significant drop in the yuan would prompt Japan to unleash another quantitative-easing blitz. The same goes for South Korea, whose exports are already hurting. Singapore might feel compelled to expand upon last week’s move to weaken its dollar. Before long, officials in Bangkok, Hanoi, Jakarta, Manila, Taipei and even Latin America might act to protect their economies’ competitiveness…

There’s obvious danger in so many economies engaging in this race to the bottom. It will create unprecedented levels of volatility in markets and set in motion flows of hot money that overwhelm developing economies, inflating asset bubbles and pushing down bond rates irrationally low. Consider that Germany’s 10-year debt yields briefly fell below Japan’s (they’re both now in the 0.35 percent to 0.36 percent range). In a world in which the Bank of Japan, the European Central Bank and the Federal Reserve are running competing QE programs, the task of pricing risk can get mighty fuzzy.

Early Look: Deflation Clouds Loom Over China’s Economy

The [Chinese] consumer-price index, a main gauge of inflation, likely rose only 0.9% from a year earlier, according to a median forecast of 13 economists surveyed by the Wall Street Journal

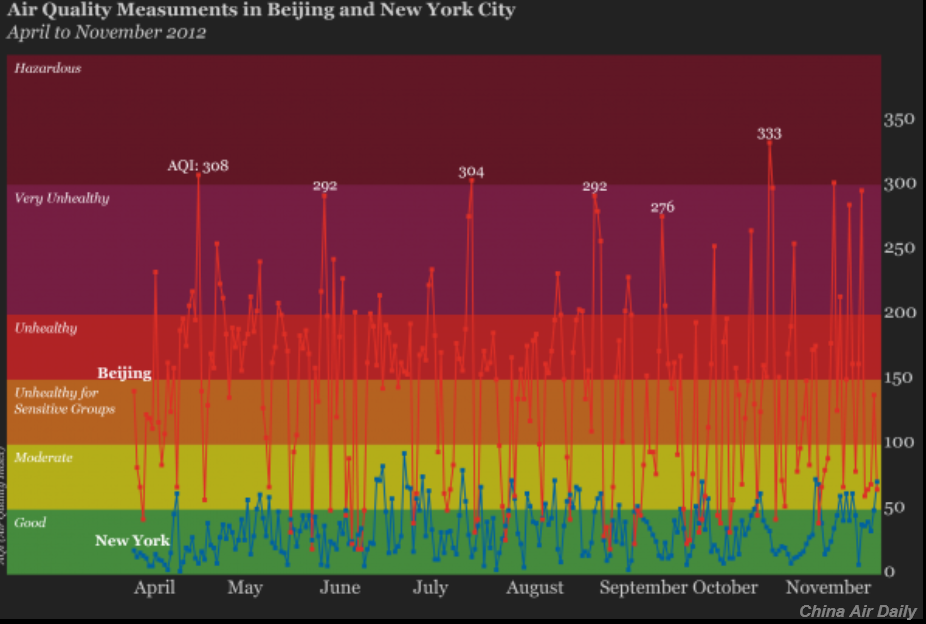

China’s Air Pollution: The Tipping Point

Energy and Renewables

Good News About How America Uses Energy A lot more solar and renewables, increasing energy efficiency – all probably contributors to the Saudi move to push oil prices back to historic lows, wean consumers from green energy and conservation.

Nuclear will die. Solar will live Companion piece to the above. Noah Smith curates Noahpinion, one of the best and quirkiest economics blogs out there. Here’s Smith on the reason nuclear is toast (in his opinion) –

There are three basic reasons conventional nuclear is dead: cost, safety risk, and obsolescence risk. These factors all interact.

First, cost. Unlike solar, which can be installed in small or large batches, a nuclear plant requires an absolutely huge investment. A single nuclear plant can cost on the order of $10 billion U.S. That is a big chunk of change to plunk down on one plant. Only very large companies, like General Electric or Hitachi, can afford to make that kind of investment, and it often relies on huge loans from governments or from giant megabanks. Where solar is being installed by nimble, gritty entrepreneurs, nuclear is still forced to follow the gigantic corporatist model of the 1950s.

Second, safety risk. In 1945, the U.S. military used nuclear weapons to destroy Hiroshima and Nagasaki, but a decade later, these were thriving, bustling cities again. Contrast that with Fukushima, site of the 2011 Japanese nuclear meltdown, where whole towns are still abandoned. Or look at Chernobyl, almost three decades after its meltdown. It will be many decades before anyone lives in those places again. Nuclear accidents are very rare, but they are also very catastrophic – if one happens, you lose an entire geographical region to human habitation.

Finally, there is the risk of obsolescence. Uranium fission is a mature technology – its costs are not going to change much in the future. Alternatives, like solar, are young technologies – the continued staggering drops in the cost of solar prove it. So if you plunk down $10 billion to build a nuclear plant, thinking that solar is too expensive to compete, the situation can easily reverse in a couple of years, before you’ve recouped your massive fixed costs.

Owners of the wind Greenpeace blog post on Denmark’s extraordinary and successful embrace of wind power.

What’s driving the price of oil down? Econbrowser is always a good read on energy topics, and this post is no exception. Demand factors tend to be downplayed in favor of stories about Saudi production quotas.