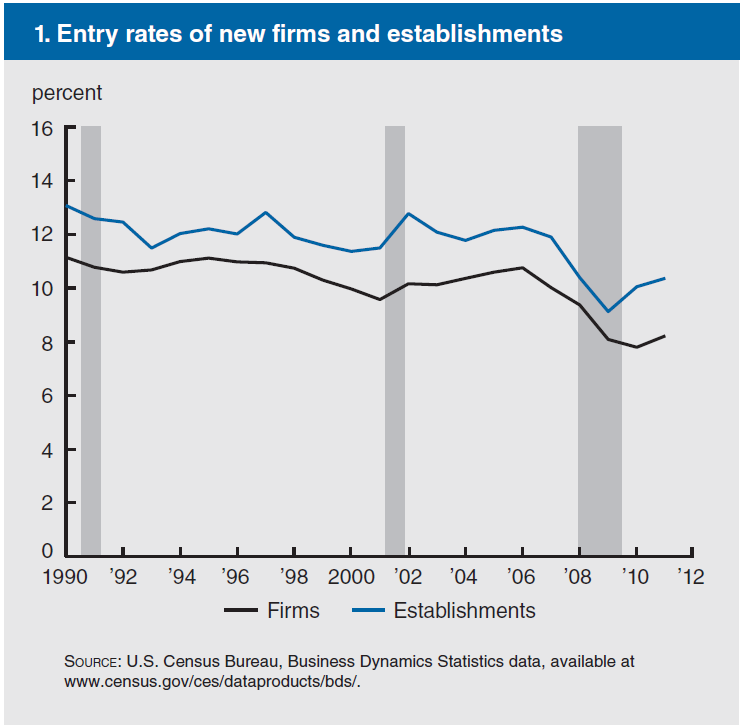

Here’s a puzzle. Why has the rate of new business creation declined fairly consistently for the past 20 or so years? This contrasts with the idea the US is an entrepreneurial nation, that it is the heartland of the “free market” and place where new jobs are created by myriads of startups.

This pattern is well-established, and is validated by several sources, including a recent Brookings report and Letter of the Chicago Federal Reserve Bank.

There are a cluster of causes, but two words are iconic – Walmart and China.

The Big Box store is a major factor behind the decline in small business startups, with Walmart being the leading superstore. And, for the most part, Big Box stores act as conduits for Chinese-made consumer goods.

Superstore Community Impact

In 2012, Walmart employed about 1 percent of the American workforce in its nearly 5000 stores, and clocked sales of $444 billion in the $17 trillion US economy overall. Certainly significant.

The story is that a Walmart comes to town and Mainstreet shutters up, becomes a ghost town. Gone are dozens of small proprietors and, many say, the sense of community. Instead we have endless aisles of cheap products from China – aisles where clerical assistance is scanty and the clerks often seem kind of lost in the vastness of it all.

Well, elements of this story are well-documented.

For example, there is a great website maintained by the Kennedy School at Harvard which updates the impact studies, even linking the coming of Walmart to an increase in obsesity somehow (lower wages, cheaper deep fat fried food?).

The first Walmart, Target, and K-Mart stores opened in 1962 with a focus on deep discounts and suburban locations.

In the five decades since, the American retail landscape and built environment have been profoundly altered. At the end of 2013, Wal-Mart had 4,700 stores in the United States and Puerto Rico, while Target operated nearly 1,800 locations and Kmart just over 1,200. Then there are smaller chains — still huge by any measure — as well as “category killers” and all the diverse residents of the shopping-mall ecosystem.

Selling a Cheaper Mousetrap: Wal-Mart’s Effect on Retail Prices shows that Wal-Mart’s price impact is large and can be beneficial to consumers.

The analysis combines data on the opening dates of all US Wal-Mart stores with average city-level retail prices of several narrowly-defined commonly-purchased goods over the period 1982-2002. I focus on 10 specific items likely to be sold at Wal-Mart stores and analyze their price dynamics in 165 US cities before and after Wal-Mart entry. I find price declines of 1.5%-3% for many products in the short run, with the largest price effects occurring for aspirin, laundry detergent, toothpaste and shampoo. Long-run price declines tend to be much larger, and in some specifications range from 7-13%. These effects are driven mostly by relatively small cities, which have high ratios of retail establishments to population.

The redoubtable Jerry Hausman of MIT argues that the Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) calculations should be adjusted downward, when full account of Walmart and other superstores’ impact on retail is folded into the calculation.

The jobs impact has been widely studied and is difficult to assess in a controlled framework, but one thing is certain – pay is generally lower (partly since there are no more owner/operators). See also A Downward Push.

One question is whether this is a race to the bottom. But the antidote, should this be true, is not my immediate focus. Rather I want to try to trace the connections between the Big Box stores and other collateral and linked developments.

Big Box Stores as Channels For Chinese Goods

There’s a scrappy website that sends people to check where the goods in Target, K-Mart and Walmart come from – concluding that the vast majority of goods are made in China.

Again, Walmart is iconic.

The Wal-Mart effect claims that Wal-Mart was responsible for $27 billion in U.S. imports from China in 2006 and 11% of the growth of the total U.S. trade deficit with China between 2001 and 2006

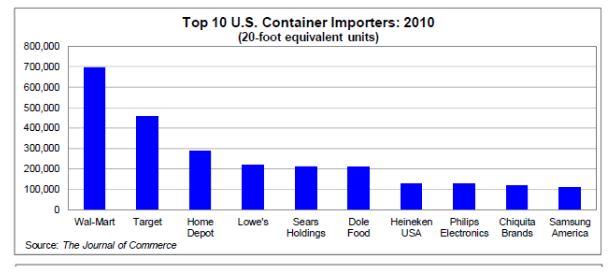

Cargo containers are the innovation which makes this possible, and there is no clearer evidence for the supply sources for the Big Box stores than their record of imports with cargo containers.

This chart shows the number of standard-sized containers going to the top ten container importers.

So the supply-chain extends from Guandong Province to Kansas City, using cargo containers which are first shipped on the ocean, then loaded onto rail cars or trucks and moved to distribution centers, then put out on shelves in the Big Box stores.

China and US Manufacturing

It is no secret that Chinese tools, Chinese-made textiles, and Chinese-assembled electronics generally are cheaper than equivalent goods made in the United States. And it is not just China. There are other low wage supply areas, such as the Malquidores along the border with Mexico and in Guadalahara, as well as contract manufacturers in Vietnam and Eastern Europe.

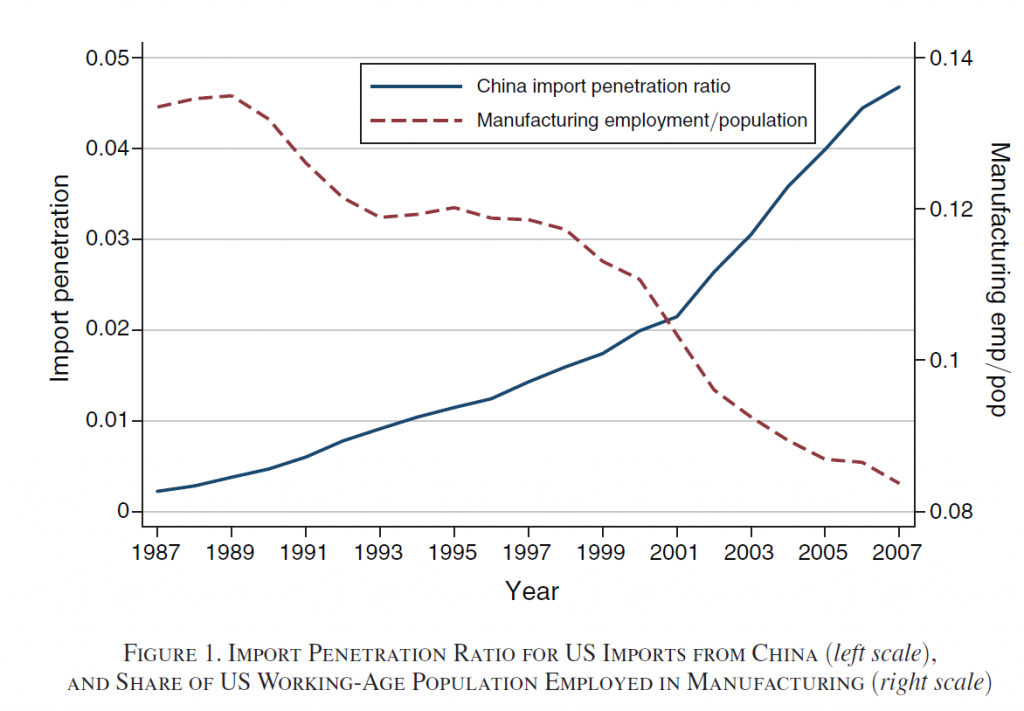

But, again, China-made consumer goods are iconic, and they have displaced US-made products across a swath of markets.

The Economic Policy Institute (EPI) estimated in 2007 that Chinese-made goods for Walmart alone displaced 200,000 US jobs.

Interestingly, this estimate, developed by a left-leaning research institute in the middle of the last decade, is now more-or-less echoed by mainstream economics – or at least by recent research published in the American Economic Review.

The China Syndrome: Local Labor Market Effects of Import Competition in the United States

We find that local labor markets that are exposed to rising low-income-country imports due to China’s rising competitiveness experience increased unemployment, decreased labor-force participation, and increased use of disability and other transfer benefits, as well as lower wages.

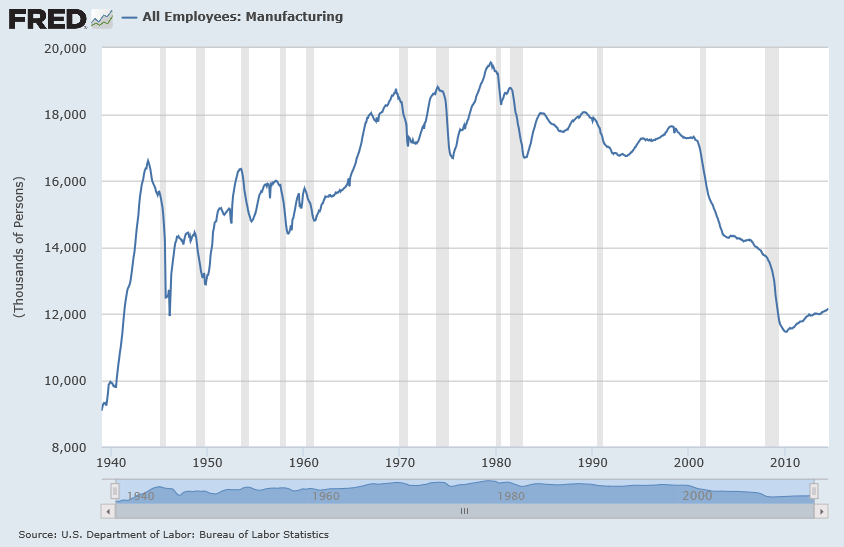

Just to be clear, here is a chart showing the dynamics of US manufacturing employment over the last 60 or so years.

US employment in manufacturing has fallen to the level it was in the late 1940’s.

Additionally, about 4 million of the 12 million persons currently employed in manufacturing are administrative and support personnel.

The US Trade Deficit

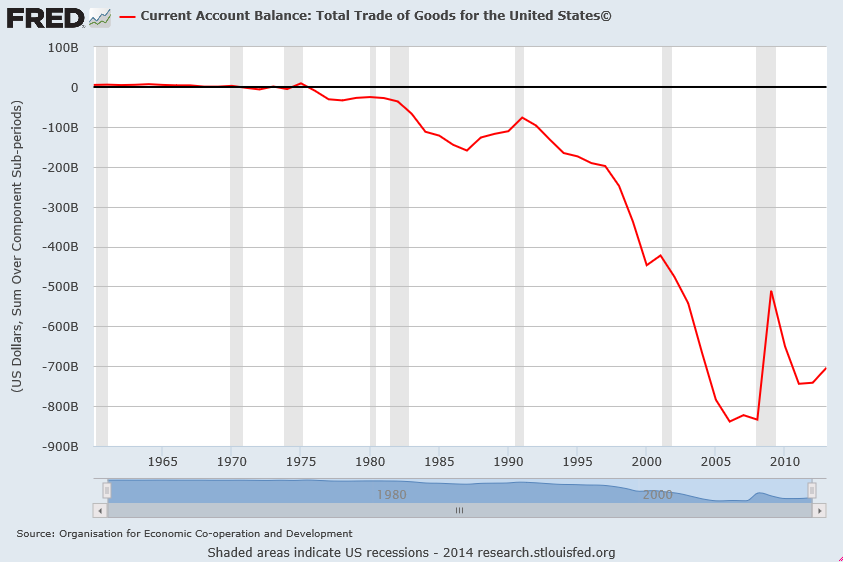

While we are viewing a collage of graphs on the US condition, let’s not forget this memorable chart of the US trade deficit.

Interestingly, the US balance of trade went south in synch with the activities of the World Trade Organization and agreements on opening trade around the world.

Of course, Walmart is not exclusively or even entirely responsible for these developments, but is part of the story.

Summing Up

Well, I began with the puzzle of the decline in new business formation in the US, focusing on Walmart and then Chinese products. Along the way, I highlight other possible connections, such as decline of US manufacturing employment and lower wages as well as prices.

Any exploration along these lines is bound to seem anecdotal, but at least there are numbers and charts to speak for themselves, to an extent.

On the one hand, we have new shopping centers with Big Box stores springing up all over the place, limiting opportunities for smaller businesses in the community. On the other hand, there is decline of US manufacturing, and loss of jobs accessible to persons without college education or special skills, jobs that can pay about double or triple what standard fast food sector jobs pay.

These twin trends clearly drive polarization of the US economy and society, mitigated to a degree by the lower cost of consumer goods supplied under this new system.

Looking ahead, can the magic of cheap imports can go on indefinitely? There are bottlenecks of workers with certain skills now emerging in China, and wages are rising there.

Possibly, contract manufacturers and joint ventures can move on to other locales, like Vietnam or Bangladesh.

But at some point, geopolitical risk and problems of infrastructure may slow outsourcing.

One thing – the rejoicing about “in-sourcing” – factories coming back state-side – seems premature, almost an example of wishful thinking. There are few numbers to back up the happy talk.

In the meanwhile, the slack thinking of American elites to the effect that it’s not necessary and may even be counterproductive to really educate a workforce that will predominately occupy low-paying service sectors jobs may come back to haunt us.

Investments in infrastructure are lagging. Federal spending on medical research has been cut back. Expenditures on R&D are flat to declining in many fields.

Practically the only “deal” available to many younger people without pedigrees or family resources is the US military. And production of defense goods is one area of US manufacturing where high performance activity continues – although offshore contracts there could, in my opinion, sap or even sabotage the ultimate performance of the equipment and material.

I’m working on companion pieces in coming weeks. I want to develop a big picture of the US economy and society at this moment, although I will continue to focus on business forecasting per se in the posts.