It is widely expected the US Federal Reserve Bank will raise the federal funds rate from its seven-year low below 0.25 percent to maybe 0.50 percent. Then, further increases will bring this key short term rate back in line with its historic profile gradually, depending on the health of the US economy and international factors.

This will probably occur next week at the meeting of the Federal Open Market Committee (FOMC), December 15-16.

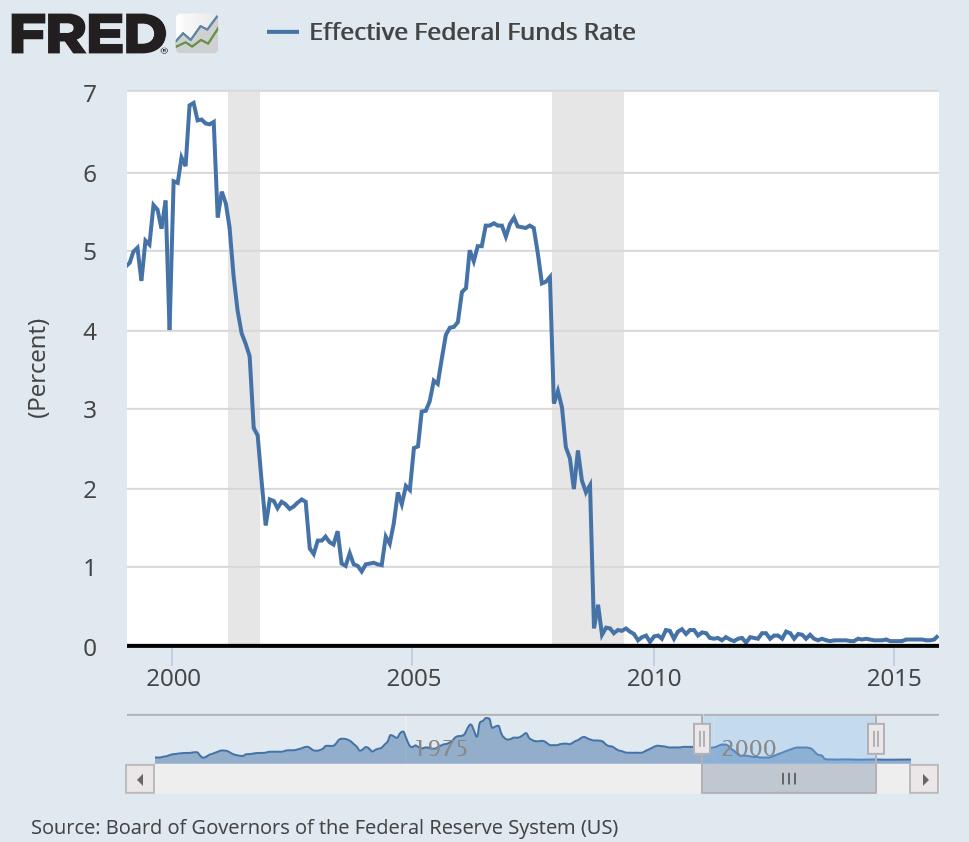

Here’s a chart from the excellent St. Louis Federal Reserve data site (FRED) showing how unusual recent years are in terms of this key interest rate.

Shading in the chart indicates periods of recession.

Thus, the federal funds rate – which is the rate charged on overnight loans to banking members of the Federal Reserve system – was pushed to the zero bound as a response to the financial crisis and recession 2008-2009.

A December increase has been discussed by prominent members of the Federal Open Market Committee and, of course, in Janet Yellen’s testimony before the US Congress, December 3.

Yet discussion still considers the balance between ‘doves’ and ‘hawks’ on the FOMC. Next year, apparently, FOMC membership may shift toward more ‘hawks’ in voting positions – bankers who see inflation risks from the current recovery. See, for example, Richard Grossman’s Birdwatching at the Federal Reserve.

How far will interest rates rise? One way to address this is by considering the Fed funds futures contract. Currently, the CME futures data indicate a rise to 1.73% over the next 36 months.

All this seems long overdue, based on historical interest rate levels, but that does not stop some alarmist talk.

BIS Warns The Fed Rate Hike May Unleash The Biggest Dollar Margin Call In History

As a result, our only question for the upcoming Fed rate hike is how long it will take before the Fed, shortly after increasing rates by a modest 25 bps to “prove” to itself if not so much anyone else that the US economy is fine, will be forced to mainline trillions of dollars around the globe via swap lines for the second time in a row as the world experiences the biggest USD margin call in history.

By the end of next week or probably just after the first of 2016, interest rates may move a little from the zero bound, and from then on, one fulcrum of all business and economic forecasts will be the pace of further increases.