I’d like to establish a context for discussing longer term forecasts, in this case to 2020 and 2030.

So, just below, I give you my take on 1990-2005. A lot happened that was unanticipated at the beginning of this period. One should expect, I think, the same to be true for 2015-2030.

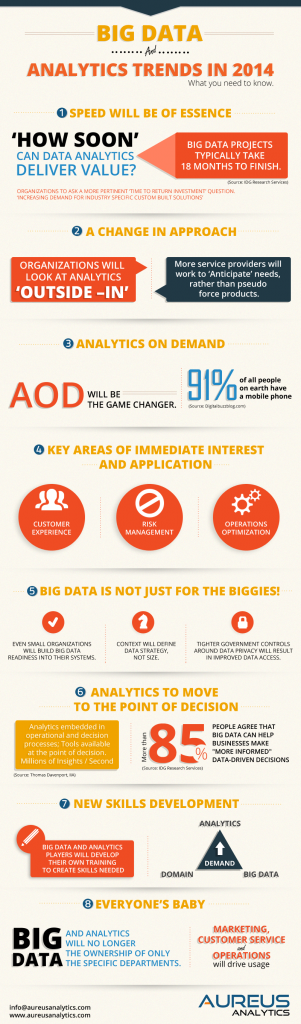

Along those lines, I also suggest Big Picture factors that may come into play over the next fifteen or so years.

In coming posts, I want to summarize forecasts and projections I have seen for this period.

And I’m a little unusual in the technical forecasting community, since I’m equipped to do matrix programming, discuss boosting and bagging and so forth, and, on the other side of the aisle, weave together these stories and scenarios about process, causes, and factors. The quantitative is usually where I get paid, but, at the same time, I think it is easy to underestimate the benefit of trying to keep track of the Big Picture, the global dynamics, the political economy, and so forth.

1990-2005

The 1990’s rolled out with a nasty little recession in 1991 and voters throwing the first George Bush out of office, in favor of a clarinet-playing former Governor of Arkansas with a penchant for the ladies. Then, the United States experienced the longest period of economic prosperity since the 1960’s, fueled by the tech revolution and rise of the Internet. The breakup of the Soviet Union became official with democratic forms struggling to take root in Russia and former Soviet Republics. The US defense budget was cut about 40 percent from 1980 levels. Deregulation became a theme, and deregulation of telecoms led to burgeoning investments in telecom systems. The end of the decade saw the absurd Y2K problem, where details of computer clocks were supposed to stop everything at midnight, the turn of the century.

The New Millennium saw another recession in 2001, which was particularly sharp for the tech industry. Another Bush took the Presidency, after the Supreme Court intervened in the disputed General Election. Then there was 9/11 – September 11, 2001, with the destruction of the World Trade Center by large airliners being flown into the upper stories. This was a pivotal event. There was immediate surge in the military budget and in US military action in Afghanistan and then the invasion of Iraq, putatively because Saddam Hussein possessed “weapons of mass destruction.”

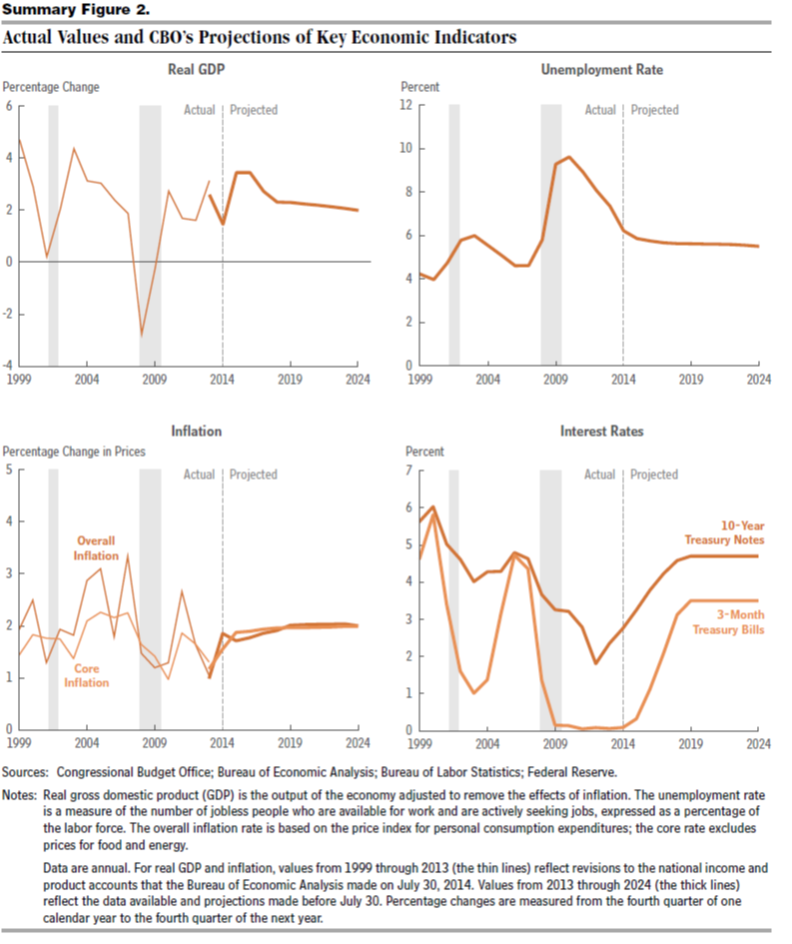

The US economy pretty much languished after the 2001-2002 recession, being stimulated to an extent by the rise in the defense budget, then by housing activity triggered by continued lowering of interest rates by the US Federal Reserve Bank under the redoubtable Alan Greenspan.

Another development that became especially noticeable after 2000 was the rise of China as a manufacturing and export power. The construction of the Shanghai skyline from the late 1990’s to the middle of the last decade was nothing less than stupendous.

The Importance of Technical Change

So what is important over a span of time? Are there underlying determinants?

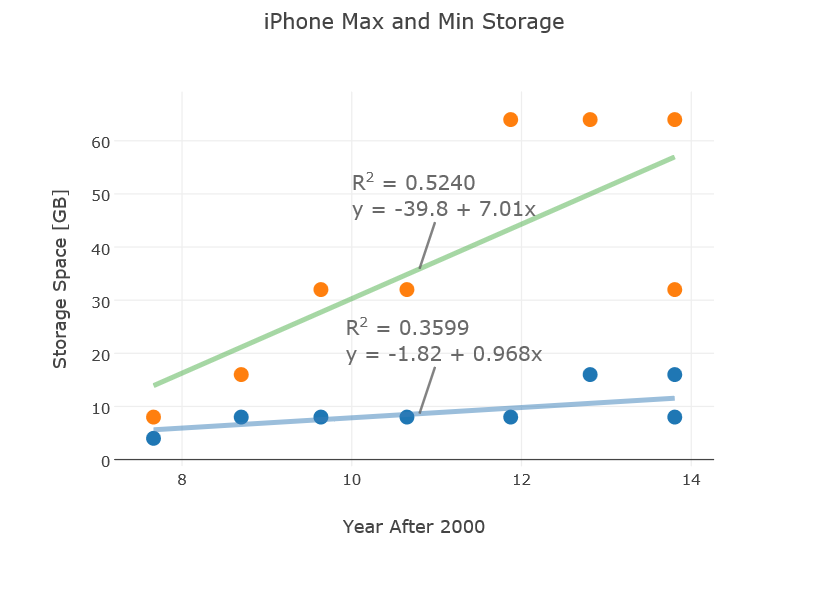

I’ve got to believe technical change is an important element in historical process. If we take the fifteen year period sketched above, for example, a lot of the story is driven, at some level, by technical developments, especially in information technology (IT).

My favorite explanation of the collapse of the Soviet Union, for example, includes Silicon Valley as a key driver. The Soviet planned economy was a huge lumbering machine, compared to the nimble, change-oriented shops in the Valley, innovating new computer setups every few months. One immediate consequence was the US fighter aircraft came to totally dominate the old MIG planes, with their electronically guided missiles and tracking systems.

And to go on in this vein, focusing on the rise of US tech and then the movement of production to China is a strategic process for understanding the past couple of decades.

Big Picture Factors

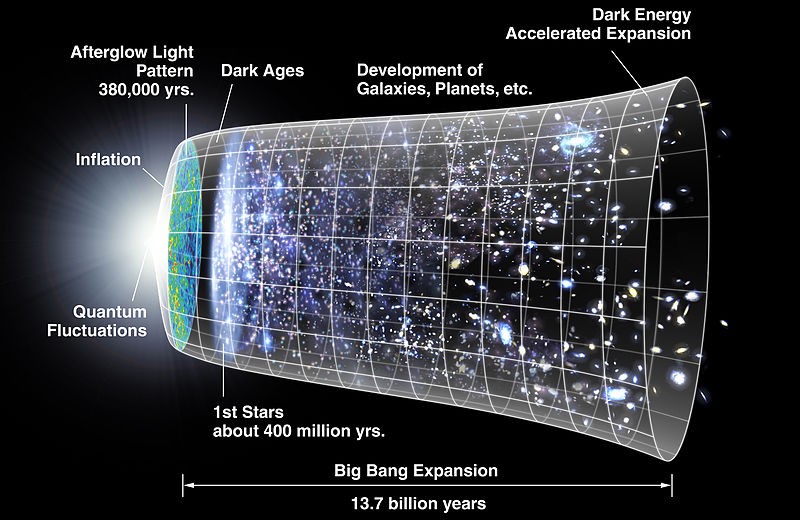

Suffice it to say – new technology will be as much a driver of change in the next fifteen years, as it has been over the past fifteen.

Indeed, according to the futurist Ray Kurzweil, something called The Singularity stalks the human future. Perhaps around 2045, somewhat outside our forecast horizon in this discussion, technology will converge to completely outperform human intelligence. Commentators ranging from Stanislaus Ulam to Kurzweil believe that it is impossible to project human history beyond this point – hence the name.

Conventionally, this will involve biotechnology, computer technology, and robotics – but also could involve nanotechnology.

In any case, hefty doses of new technology may be necessary just to keep on a level course. I’m thinking, for example, of the diminishing effectiveness of antibiotics. So we have the evolution of “superbugs,” as well as the emergence of new epidemics through mutation or disease vectors jumping species lines. Ebola is a particularly gruesome example.

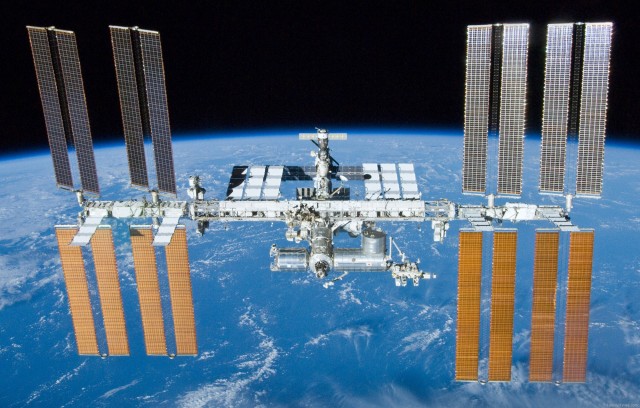

And while on technology, it is fair to observe that complex technologies just at or beyond the boundary of human control present deep challenges. Deep-sea oil drilling and the Gulf of Mexico oil spill, under British Petroleum, and the Fukishima nuclear disaster, still leaking radioactivity into the Pacific, are two examples.

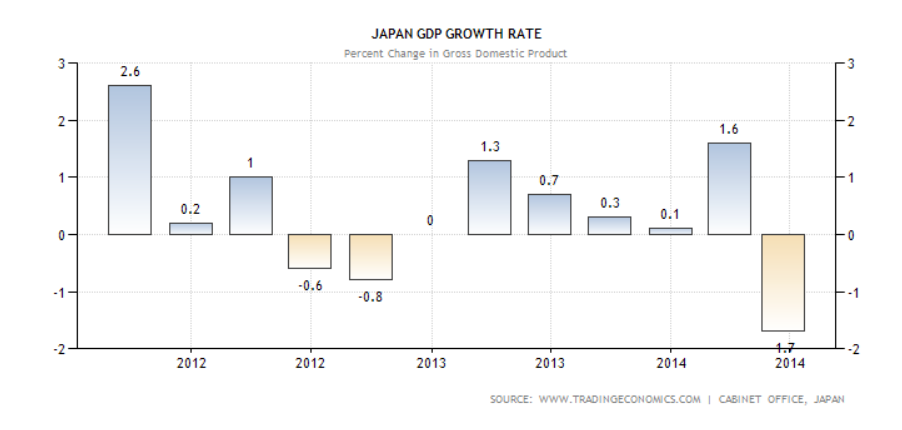

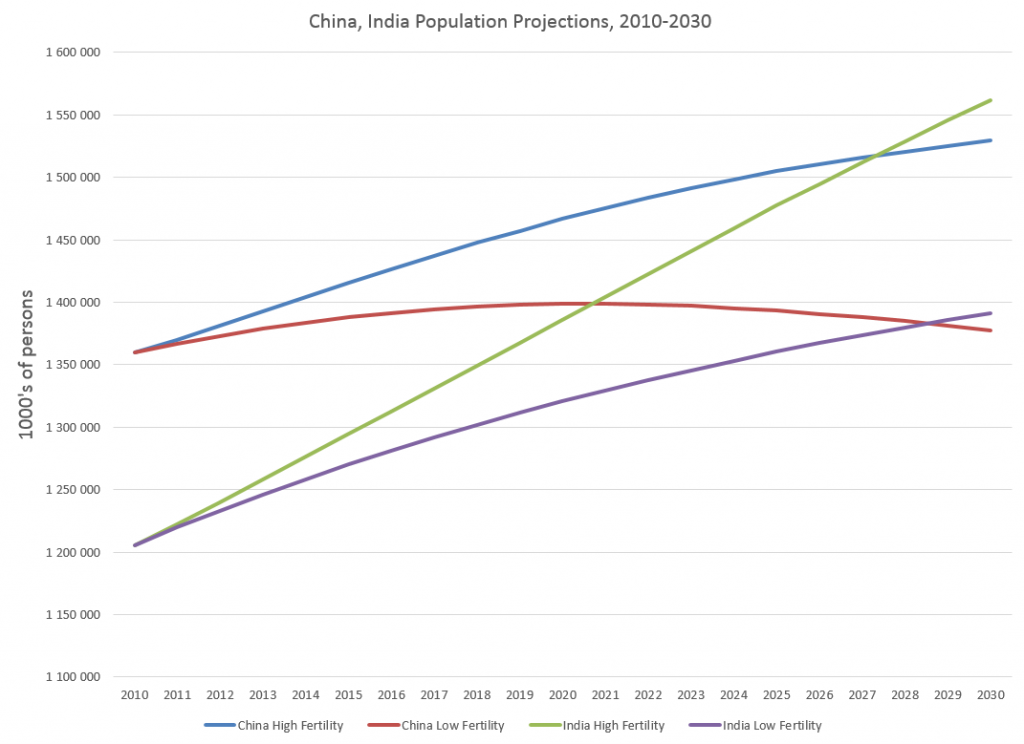

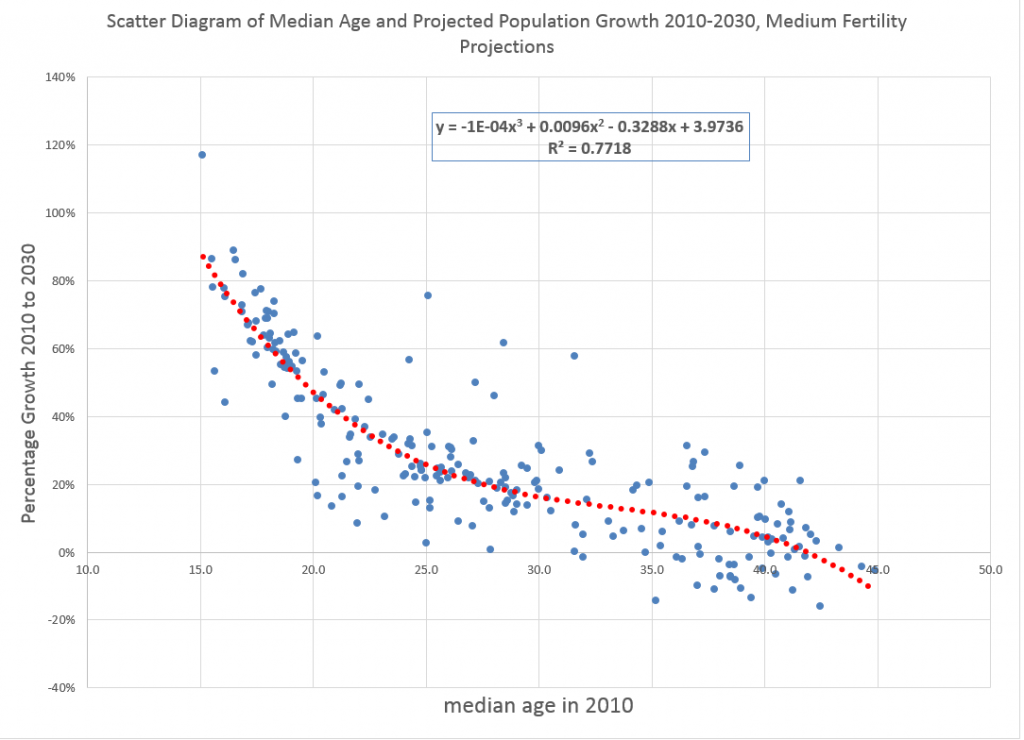

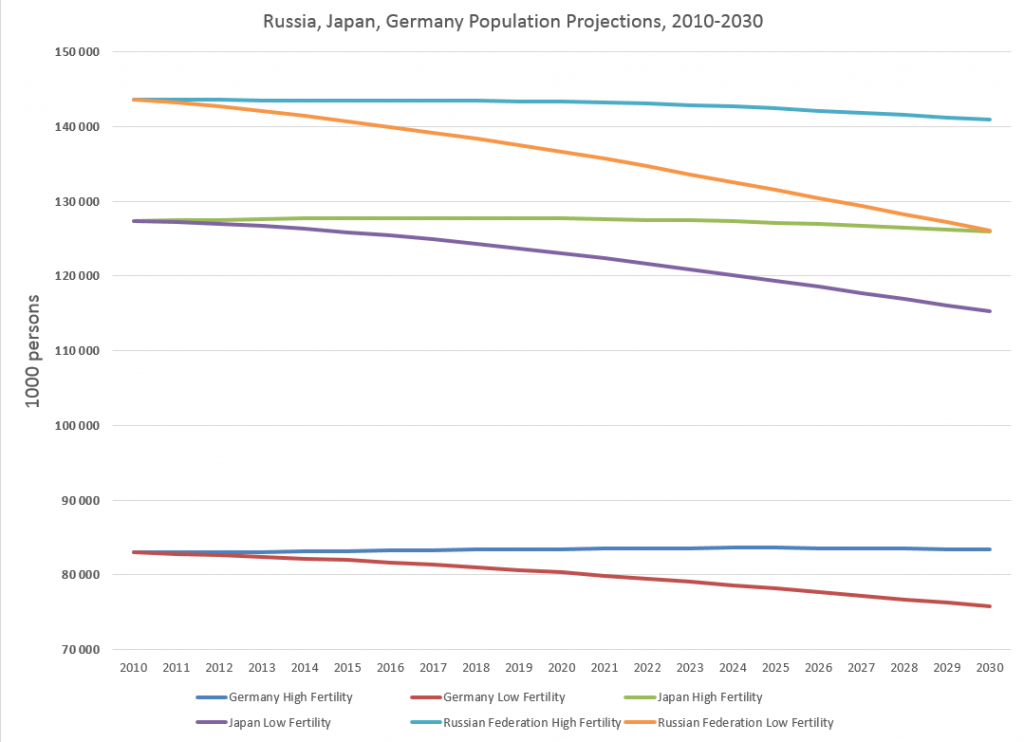

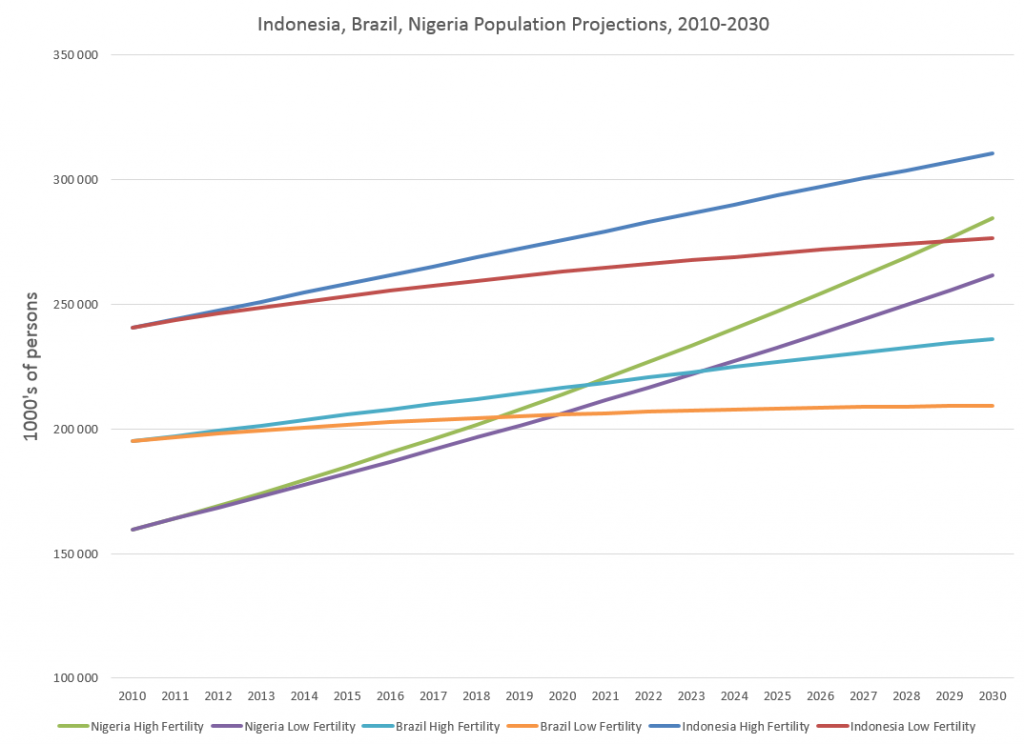

Population or more generally demography is another Big Picture factor. Populations are aging in the United States, Europe, and Japan, but also in China. And global population continues to grow, possibly by another billion by 2030.

Climate change is another Big Picture factor.

The global climate is a complex, dynamic system. There is lots of noise in the discussion and uncertainties, such as whether there may be a cooling interval, as carbon dioxide and methane concentrations continue to rise globally. A number of studies commissioned by US and other intelligence agencies, though, highlight the potential for massive impacts from, say, basic changes in monsoon patterns in South Asia.

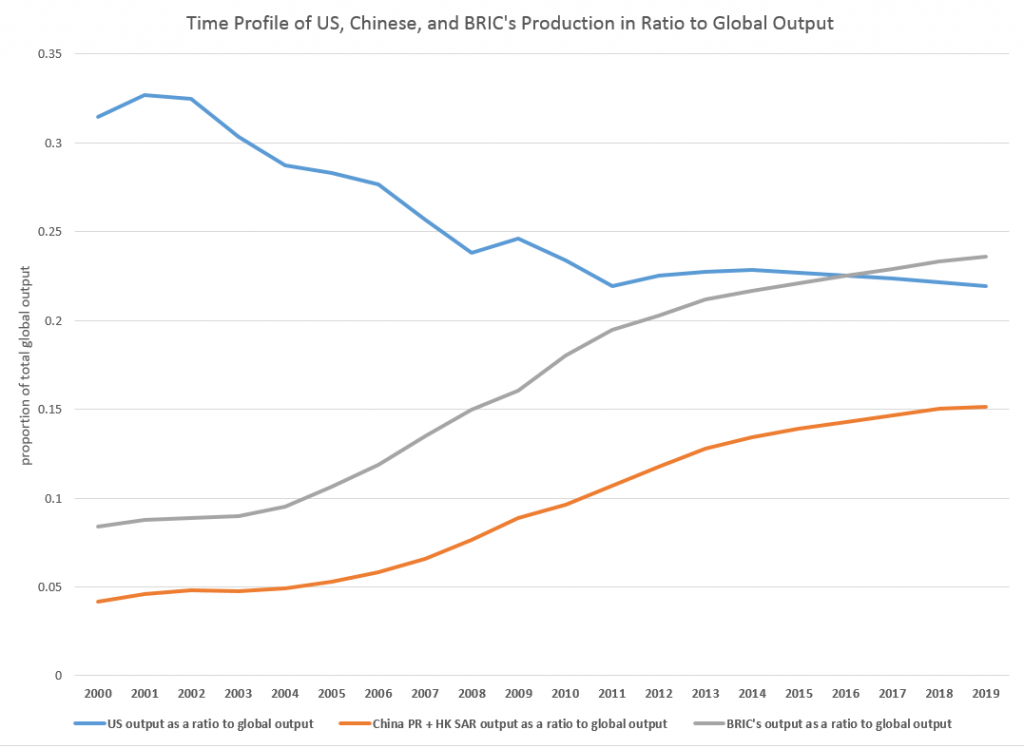

In terms of geopolitics, I suspect the shift in the economic center of gravity to somewhere along the Asian rim is another Big Picture development.

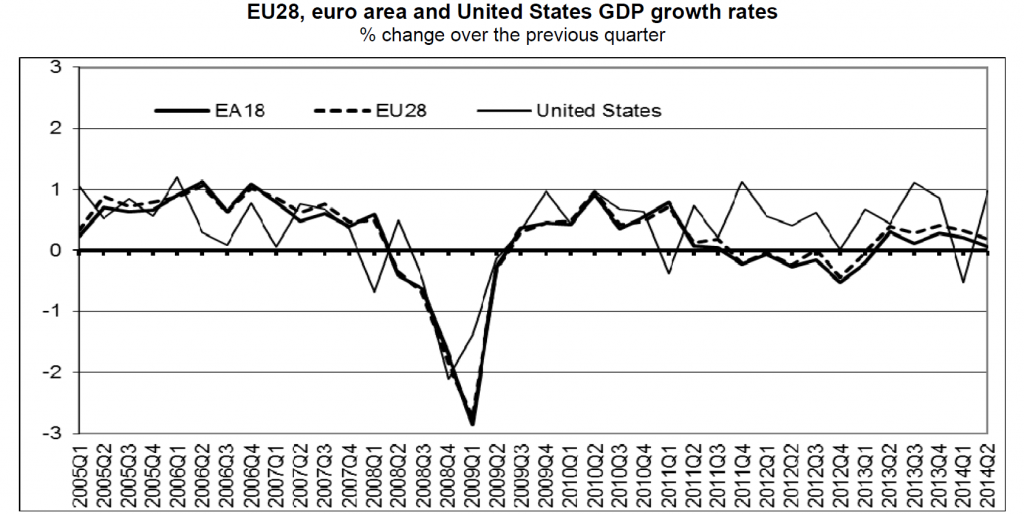

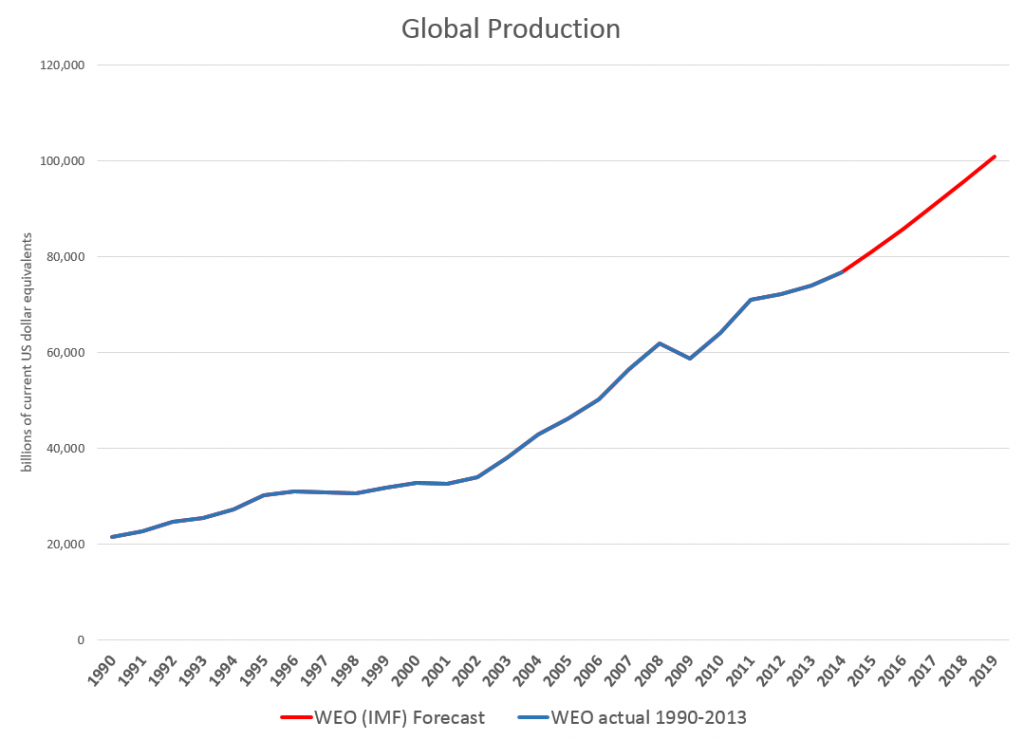

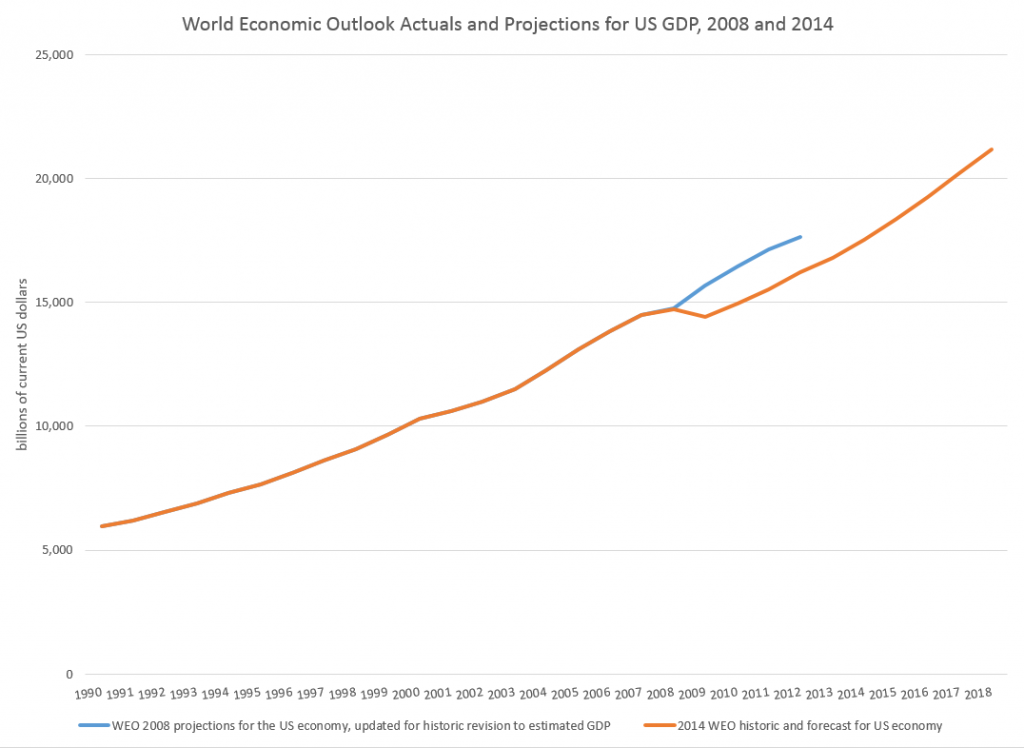

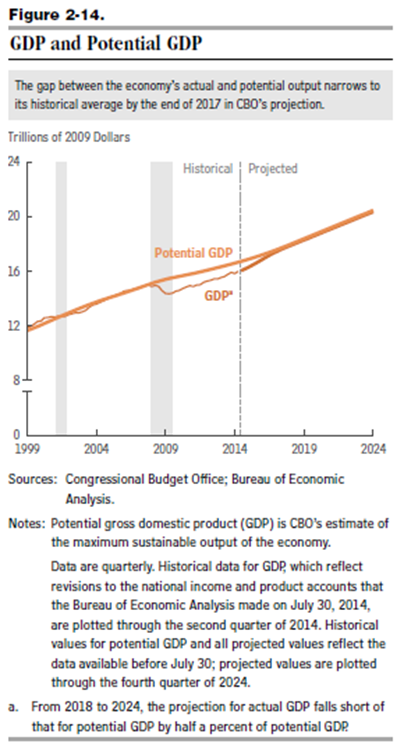

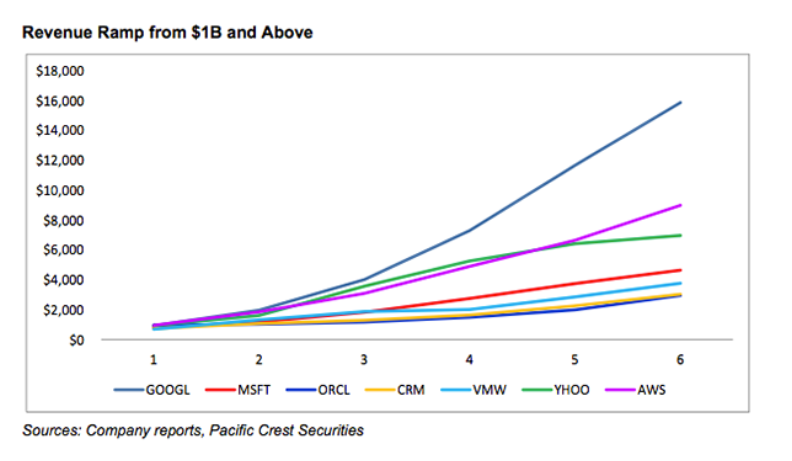

There are many relevant metrics. The proportion of global output produced by the United States, according to the World Economic Outlook (WEO) of the International Monetary Fund (IMF), will continue to diminuish, as Chinese growth in the worst case is projected to exceed levels of economic growth in the US and, certainly, in Europe.

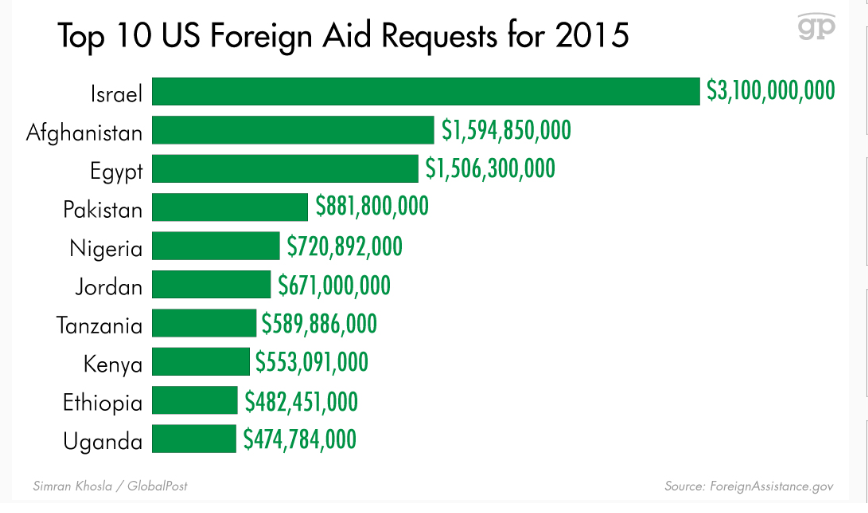

Then, there is the issue of the US being the policeman of the world. At some point, the cost of maintaining a global span of military bases and force readiness for multiple theatres of action will weigh heavily on the US – as one could argue is already happening to some degree.

Challenges to the global dominance of the US dollar can be predicted, also, in the next fifteen years.

Sustainability

Whether any of the above “Big Picture” factors actually come into play by 2020 or 2030 is, of course, a speculation. But I think the basic technique of long term forecasting is to inventory possible influences like these. Then, you construct scenarios.

One thing appears certain. And that is there will be surprises.

In looking at forecasts for the next five to fifteen years, I also want to give thought to sustainability. Are there institutions and arrangements which could offer a backup to the various types of instabilities which could emerge?

And there is apparently an increasing chance of an increase in the general level of warfare, perhaps with linking of action in various theatres. I have to say, too, that I am poorly equipped to comment on these conflicts, although, as they ramp up, I attempt to learn more about the players and underlying dynamics.

I’ll be using this venue as a scratch-pad to record the projections of others and some thoughts I might have in response vis a vis 2020 and 2030.